Warren Bueffett’s Berkshire Hathaway currently sits on around $300 million in cash. In the context of his $1 trillion market cap, that’s a 30% cash allocation!

That’s enough cash to buy a company like Walt Disney, Goldman Sachs, Pfizer, Nike, or AT&T. I honestly do my best to avoid doing business with any of these, so hopefully that is not in the cards.

That’s enough cash to buy the countries of Tonga or the Marshall Islands. I gotta admit, investing in a holding company that owns a South Pacific island state would be cool - maybe it could include shareholder perks for resort discounts and 2-for-1 drinks on the beach?

Suffice it to say, my man is hoarding A LOT of doubloons.

Why?

Does Warrenn know something we don’t? Is he expecting some type of Black Swan event in the markets? Is he hoarding cash to offset rising fear?

“be fearful when others are greedy and be greedy when others are fearful.” - Warren Buffett, 1968 letter to shareholders.

I will speculate, as I’m prone to do, a few reasons other than simple fear.

Reason Numero Uno (most probable)

He doesn’t like the valuations of anything out there right now. He’s even forgoing stock buybacks on his own company as he deems even that too expensive to buy at the moment. Warren has famously said he likes investing in “discarded cigar butts,” and evidently, everything he sees in the ashtray right now is still actively burning.

He’s not overly optimistic. Not many folks are, and it’s easy to see why…

The Schiller P/E ratio of the market, a gauge that indicates how expensive stocks are relative to their earnings, is riding at levels last seen during the dot-com bubble. That means the market is a bit - how should we say - frothy.

The same goes for the “Buffett Indicator”, which is a ratio of all the listed US stocks relative to the size of the US economy. That ratio currently sits at 208%, slightly above its peak in the dot-com bubble days. The market is kinf of peaky.

Vanguard is predicting large-cap US equities will only average about 5%/year over the next decade. They also predict investment-grade bonds to do the same - meaning their analysts don’t see much more we can squeeze out of current evaluations, and we may need some time for the metrics to catch up.

Remember - peaks do not always lead to bubbles, recessions, depressions, or other hard lessons. Often, things just naturally cool off for a bit and then naturally pick back up again…

Reason Numero Two (probable)

Friction. With Berkshire Hathaway sitting at on a $1 trillion market cap, it’s going to take a $100 million (10%) deal to really move the needle.

Consider, too, that Buffett can’t really sign into his E-Trade account and just buy the stock. He’ll have to pay a 20% premium to lawyers, investment banks, and the like.

That’s a cool $20 million-plus on a sizeable deal, which is why Wall Street brokers live in the Hamptons and snort cocaine off the ass cheeks of Slavic models - and that’s just at the Tuesday night parties.

Reason Number Three (a distinct possibility)

There are a lot of rumors he’s sizing up something big in Japan, having recently raised copious amounts of capital by selling global bonds price in the Yen. Perhaps he’s about to buy a well-known Japanese company. He’s much more of a Dairy Queen guy than an omakase fan, but who knows…

Reason Four (way out on a limb here)

Let’s be frank; the dude is 94 years old. Perhaps he’s setting up a one-time memorial dividend to shareholders? Berkshire Hathaway has never paid a dividend in its history… so what better time than to go out with a bang? Peace out rubes, here’s a cool 8% on your holdings…

Should We Be Doing the Same?

No. You’re not Warren Buffett. You’re not a hedge fund. You’re not parked on enough cash to purchase South Pacific nations.

Notice none of my reasons for the cash-hoarding focus on market crashes or bubbles bursting. Don’t hoard cash out of fear. Have a plan.

Stay invested, and most importantly, stay diversified. Now more than ever.

Why?

Look at Vanguard’s 10-year predictions... They have international stocks running 9%/year and U.S. small caps running 7%/year. Hell, they have commodities at 6-8%/year (commodities are ridiculously cheap right now). All of these sit with higher estimated returns than US large-cap stocks.

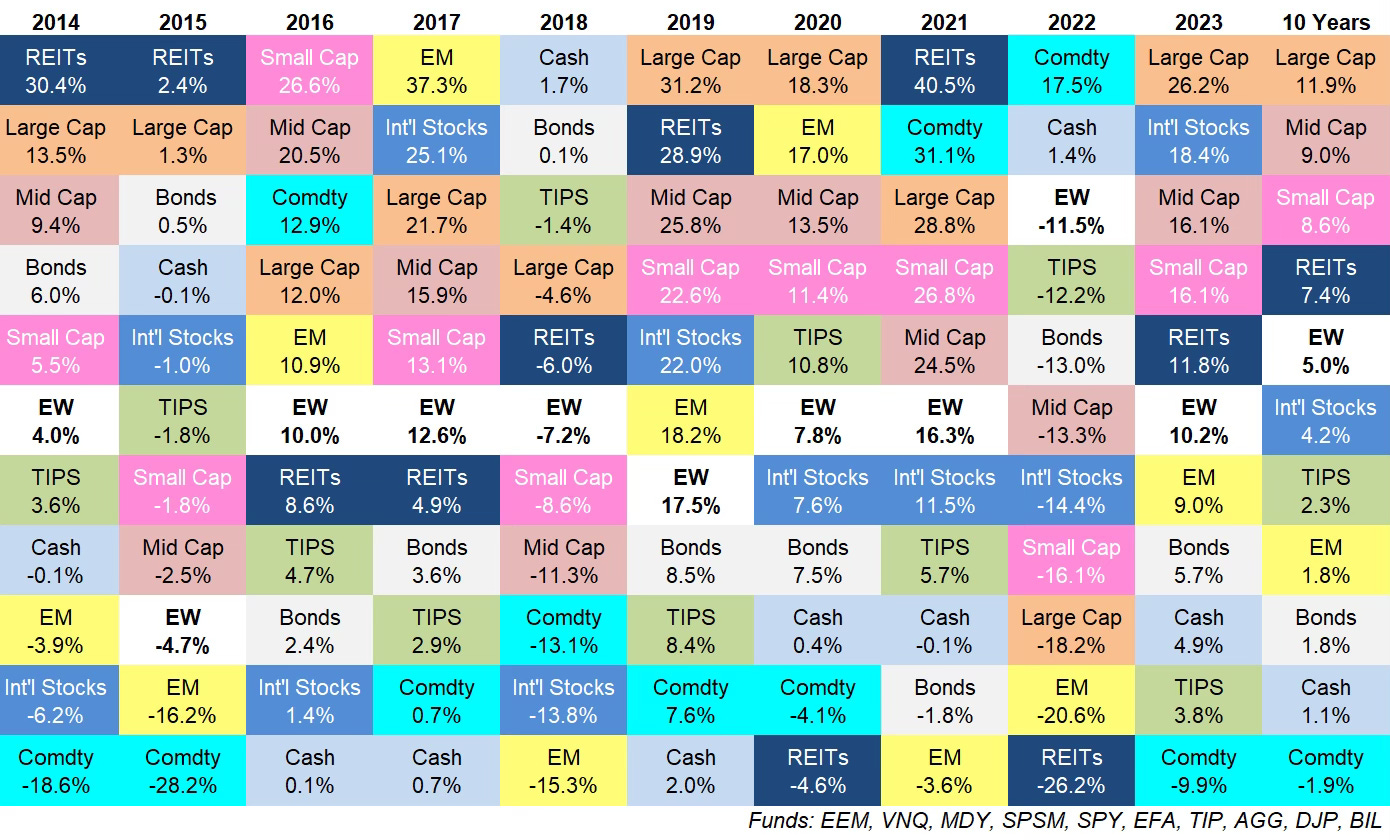

Don’t have all your eggs in one basket. Here’s an asset quilt looking back at the last 10 years to show you why diversification is critically important.

Cash?

And if you do have piles of cash, consider this - I’m getting a 4.2% yield on short-term Treasuries SHY 0.00%↑ and I’m getting 4.6% on my cash $SWVXX. Which is better?

As interest rates continue to fall (and I believe they will), I will see my capital appreciate on the Treasuries (bond prices rise as interest rates fall), so that’s the better long-term run. Until then, parking cash in a Money-Market fund is not bad at all…

A little cash in your retirement accounts is fine. I’d guesstimate 5-10%. Running a 25% like Uncle Warren is at the moment might be a bit salty - unless you have a very specific plan.

And if you do have a very specific plan for a mountain of cash, I’d love to hear it…

In Conclusion

To summarize - Buffett is not hoarding cash in preparation of a Doomsday Scenario. He’s not saving up for a Nuclear Winter or Black Swan event. He doesn’t think the economy is poised to go tits up. He’s simply indicated nothing of the sort.

Warren Buffett refers to his large cash holdings as a "call option", giving him the flexibility to invest in any asset class at any time, essentially acting like an option with no expiration date and no specific strike price. This allows him to capitalize on future market opportunities when he sees them, and trust me… he WILL see them.

Cheers to the Oracle of Omaha… and thanks for reading!

disclaimer - I am long $BRK.B, $SHY, $SWVXX and I have never visited Tonga or snorted cocaine off a Slavic model’s ass, though I’d like to… (visit Tonga).