I love a good quilt.

Hold up, stay with me here. Before you think I’m about to change the graphics of my Substack to subtle hues of pink and baby blue let me explain… I love a good asset quilt.

My yearly go-to for quilting my assets is Ben Carlson’s quilt on his Twitter. The quilt is a visual representation of how each asset class performed during the prior year.

Let me pause one moment to give my highest “Man on the Move” recommendation to following Ben Carlson & Michael Batnick on Twitter and listening weekly to their Animal Spirits podcast. If you’re not listening to and reading these guys, you’re not in the know and you’re missing out.

Now, let’s get back to the quilting. Take a look at 2022! What a total and complete shit show! Stocks bonds, even TIPS were all down and down hard! Real Estate was the worst performance of the lot! Only Cash & Commodities were spared the carnage, and I doubt any of us were heavily invested in that direction!

Diversification

If this does not speak to the value of diversification, I don’t know what does. However, before you go throwing all your eggs (or pork bellies) into the commodities basket to chase last year’s 17% gain let’s talk for a moment.

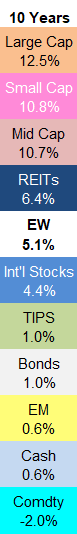

Let’s talk about asset allocation because that’s the most important part of this conversation. Yes, you got shit-canned in 2022, we all did. However, long term investors are looking at the column far right. This is the 10 year average, and what you’ll see is that a traditional allocation model still works over the long term.

Stocks at the top and you’ve got a good mix of REITs and even international investments just below that. Bonds and cash hold their ground at the bottom, and a little exposure to commodities as a hedge.

Going Global

In looking at this asset quilt, let’s consider globally diversified portfolio made up of all the components you see listed. Such a portfolio is going to cut right through the middle of the quilt above - as referenced by the white EW (Equal Weight) squares in the quilt.

Allocated across all asset classes, you’ll never see your globally diversified portfolio sitting at the top of the chart, but you’ll also avoid bouncing your portfolio off the bottom. Slow and steady wins the race - and avoids disaster.

If you had all your money (or a large portion) in real estate last year, your recovery from a 30% hit will take decades! That, my friends, is portfolio disaster!

How Does One Allocate?

Traditional asset allocations sometimes look very simple. You’ll read of a 90/10 stocks/bonds allocation, or the traditional 60/40. These types of allocations fail to take advantage of (or delineate) the numerous asset classes available to us. Of your 90% in stocks, how much large cap versus small cap versus international should you own?

Here is one example, from Schwab’s Managed Growth Portfolio:

For more on this you can look at Schwab’s “Why Global Diversification Makes Sense”. Here you’ll see that their stock/bond allocation gets broken down into the components more closely tracking the asset classes seen above. Schwab’s “stock” portion of a portfolio is broken down into as many as 14 sub-sectors. Bonds are broken down into as many as 10 sub sectors.

You can use Schwab’s modeling, back-testing, and algorithmic approaches to asset allocation + sector weighting. Your aim here is to minimize risk and maximize reward by properly weighting your portfolio - not guessing, not throwing darts, not chasing returns, not “oh I think MSFT will be hot this year” - but using math in your favor.

Other companies doing similar work are Betterment, Vanguard, and Wealthfront.

A Quick History Lesson

Economist Harry Markowitz introduced the concept + benefit of asset diversification back in 1952. He called diversification "the only free lunch in finance." His work, which won a Nobel Prize in Economics, showed how an investor can reduce overall portfolio risk by investing in asset classes (the quilt) that have low correlations to each other. This was dubbed “Modern Portfolio Theory”. By allocating your investments over a wide range of asset classes, you can smooth out the up and downs of individual stocks while earning higher returns. The free lunch part? No additional risk!

A decade later, William Sharpe built upon Markowitz’s work to define the relationship of risk to return (“beta”) and solved for the question, “am I being properly rewarded for my level of risk”?

For a more scientific “white paper” look at these concepts and how they can be applied today, you can dig in here. (caution… super-nerdy)

Grandma Was Right

You’ve heard it since you were a kid - “don’t put all your eggs in one basket”. Looking at the quilt above, the reasoning behind that sage advice could not be more clear.

So next we have to ask “If I need several baskets, and some baskets are bigger than other baskets so they can hold more eggs, how many eggs do I put in each basket?”

It’s not an easy answer because there’s no “one size fits all”. Your appetite for risk, your investment timeframe, and your investing goals will all come into play.

Note, I have no recommendation or affiliation with the companies above, but if you want to get started or learn more, they are good places to start.

Until then, please subscribe, share, and comment.

Cheers, and thanks for reading!